1. The supervisory board office

As the responsibilities and demands placed on supervisory boards grow, their members are under more and more pressure organisationally. One way to address these challenges is to set up a supervisory board office. Depending on the responsibilities delegated to it, such an office can assist both the supervisory board and the management board in providing information to the supervisory board members, or it can function as the liaison between the two corporate bodies. According to our survey however, this approach remains not very widespread. One reason for this may still be the lack of awareness that there continues to be about the advantages of such an office. Like last year, a clear majority of the supervisory board members we surveyed responded with 'no' (69 per cent in 2024 and 67 per cent in 2023) to the question of whether or not there was a distinct supervisory board office at their company; that answer was given by 63 per cent of respondents from listed companies and by 74 per cent of those at unlisted companies.

2. Responsibility for the organisation of the supervisory board

A consistent trend can be observed regarding the responsibility for supervisory boards' organisation: this year, 71 per cent of the supervisory board members we surveyed stated – in 2023 it was only 61 per cent – that this responsibility rested with the management board. This response came from 74 per cent of supervisory board members at listed companies and 64 per cent of those at unlisted ones. Another 28 per cent said that their supervisory board itself was in charge of its own organisation. Only 2 per cent of surveyed members of unlisted companies' supervisory boards stated that an external service provider was taking care of the organisation, whereas that was not happening at all at listed companies.

3. A supervisory board budget

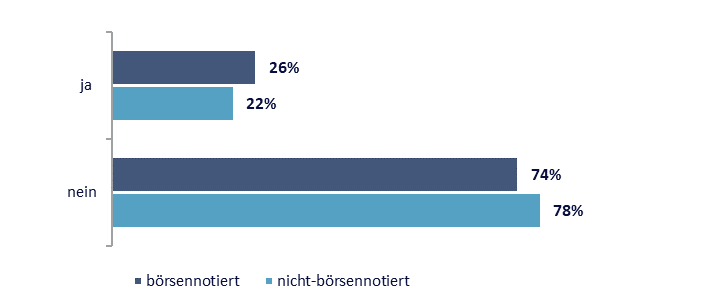

The increased obligations and requirements placed on supervisory boards have also led to higher costs and expenditure. Because of that, the question of whether or not the supervisory board should have its own budget to ensure that it can fulfil its tasks and be independent of the management board is sparking debate again and again. Our study showed however that the majority of supervisory boards surveyed still did not have their own budget: this was true at listed companies somewhat less than at unlisted companies (74 per cent and 78 per cent, respectively).

Abbildung 10: Verfügt der Aufsichtsrat in Ihrem Unternehmen über ein eigenes Budget?

Abbildung 10: Verfügt der Aufsichtsrat in Ihrem Unternehmen über ein eigenes Budget?

4. Qualification of the specialists for organising the supervisory board

Both respondent groups reported that their supervisory boards were supported primarily by administrative specialists or lawyers, but with slightly different relevance. While the specialists at publicly traded companies tended to be lawyers (40 per cent compared to 36 per cent), supervisory board members from unlisted companies responded somewhat more that their specialists were administrative staff only (41 per cent compared to 32 per cent).

5. The specialists' tasks and responsibilities

According to the respondents, the main tasks and responsibilities assumed by the specialists for organising the supervisory board include logistical support (indicated by 87 per cent) and preparing meeting documents and providing them on time (85 per cent), followed closely (80 per cent) by record-taking. By a fairly considerable margin, those tasks were trailed by 'supporting with the supervisory board's reporting' (43 per cent), 'co-ordinating committee work with the work of the entire board', 'assisting in the obtaining of qualifications or in professional development', 'co-ordinating the supervisory board's advisers and communications with auditors' and 'advising supervisory board members on technical matters' (each 31 per cent) and 'budget administration' (22 per cent).

6. Duties and tasks of nomination committees

The German Corporate Governance Code recommends that listed companies in particular institute nomination committees that are in charge of preselecting candidates for their supervisory boards. Such committees, according to the Code, must then be responsible for ensuring that the preselection process is efficient, transparent and confidential. In addition to preparing nominations for shareholder representatives at their companies, nomination committees have further tasks to perform. Where we asked in our survey what these tasks were, 68 per cent of supervisory board members responded that 'preparing skills and expertise profiles of new members' was one. Further duties of nomination committees included long-term succession planning (indicated by 58 per cent of respondents), monitoring the skills matrix (34 per cent), management board planning (30 per cent) and organising the supervisory board's self-evaluations (28 per cent). Another 16 per cent of survey respondents identified other tasks, like 'regularly preparing and verifying the skills and expertise profile of the current management board and supervisory board' and 'tasks falling within the field of governance'.

7. Importance of nomination committees

This year, for the first time, the trend in the importance of nomination committees has changed: respondents reported that the importance of the nomination committee in the work done by the supervisory board overall had increased slightly (35 per cent compared to 29 per cent in 2023). Nevertheless, our survey showed that the majority of supervisory board members still do not attach any great relevance to them. This was true at listed companies somewhat less than at unlisted companies (58 per cent and 74 per cent, respectively).

8. Nomination committees' remuneration

Remuneration for serving on a nomination committee is an aspect still handled in very different ways. Notable differences were apparent between listed and unlisted companies once again this year. Overall, 45 per cent of supervisory board members surveyed said that the members of their nomination committee were not remunerated. This was a slight decrease compared to 2023 (47 per cent). Broken down according to respondent group, this percentage continues to be higher at unlisted companies (62 per cent) than at publicly traded companies (35 per cent). In contrast, 34 per cent of all respondents stated that their companies are currently remunerating the members of this committee comparable to the members of other committees. The figures here showed that listed companies this year also tend to be more willing (45 per cent) to remunerate their nomination committee members. Another 15 per cent stated that remuneration was given exclusively in the form of an attendance fee, and 5 per cent said that remuneration was paid only if a certain minimum number of meetings took place in a calendar year.